Insights Staying the Course Amid Tariff-Induced Market Volatility

Date: 4/11/2025

After much discussion throughout the first few months of 2025, the White House announced a comprehensive tariff plan in early April that alarmed investors and led to a swift market decline. Headline news surrounding the implementation of broader tariffs, along with the uncertain business environment and lower consumer sentiment, increased market volatility. In the first quarter of 2025, U.S. stocks, as measured by the S&P 500 Index, had already declined 5%. By the end of the first week in April, the S&P 500’s year-to-date loss quickly increased to 13% after a two-day 10% selloff.

Keep in mind volatility goes both directions. With news of a temporary pause on some tariffs, the S&P 500 Index jumped 9.5% on April 9, 2025—the biggest one-day gain since 2008.

Volatility rose in 2025, as daily +1/-1% price movements of the S&P 500 occurred on 23 out of 64 trading days through the first week of April.

Information Technology and Consumer Discretionary were the worst-performing S&P 500 sectors, both falling more than 20% year-to-date through the first week in April. It is notable that while the tech-related “Magnificent Seven” (Alphabet, Amazon.com, Apple, Meta, Microsoft, NVIDIA and Tesla) contributed over 50% of the S&P 500’s double-digit return in 2024, this year, these companies declined more than 16% on average through the first week of April and accounted for over 100% of the market’s decline in the first quarter1.

The tech sector faced challenges as investors grew concerned over artificial intelligence (AI) spending, especially following Chinese AI upstart DeepSeek’s news that its AI model was more sophisticated and less expensive than other advanced models. The broader stock market struggled in the latter half of the quarter due to headline news about tariff uncertainty, weakening economic data and lower sentiment and then fell sharply on the announcement of the magnitude of global tariffs.

As volatility in the markets increased, investors gravitated to more defensive areas of the market that are not as sensitive to economic cycles. Consumer Staples, Utilities and Health Care were the best- performing S&P 500 sectors and were essentially flat on a year-to-date basis through April 4, 2025.

Short-term market downturns and heightened volatility are a normal part of investing. However, two-day declines totaling 10% or more are unusual. In fact, 2025’s two-day drop was the fourth worst since 1950 behind Black Monday in 1987, the Global Financial Crisis and in March 2020 during Covid.

TWO-DAY DECLINES OF 10% OR MORE SINCE 1950

| Declines | Date | 2-Day % Change | 1 Year Later | 2 Years Later |

|---|---|---|---|---|

| Black Monday | 10/19/1987 | -24.6% | 22.9% | 52.5% |

| Financial Crisis | 11/6/2008 | -10.0 | 18.2 | 35.2 |

| Financial Crisis | 11/20/2008 | -12.4 | 45.0 | 59.2 |

| Covid-19 | 3/12/2020 | -13.9 | 59.0 | 69.5 |

| Tariffs | 4/4/2025 | -10.5 | ? | ? |

While it may be challenging to see portfolios fall in value, investors have been historically rewarded following these significant declines. One year after the top 10 worst two-day price moves, the S&P 500 increased an average of 27%; two years later, the Index rose 40% cumulatively.2

Taking a long-term view of stocks and bonds provides some perspective:

- Since 1980, the average decline for the S&P 500 Index within a single year has averaged 14%. Yet, in 34 out of those 45 years—75% of the time—the market posted a positive annual return.1

- Over the past 50 years, the market has had a positive annual return 80% of the time.

- Over the past 20 years, the S&P 500 has returned 10% on average while bonds, as measured by the Bloomberg U.S. Aggregate Bond Index, have risen an average of 3% as of March 31, 2025.

During these periods it’s helpful to remember three time-tested strategies to help remain focused when markets are experiencing short-term volatility.

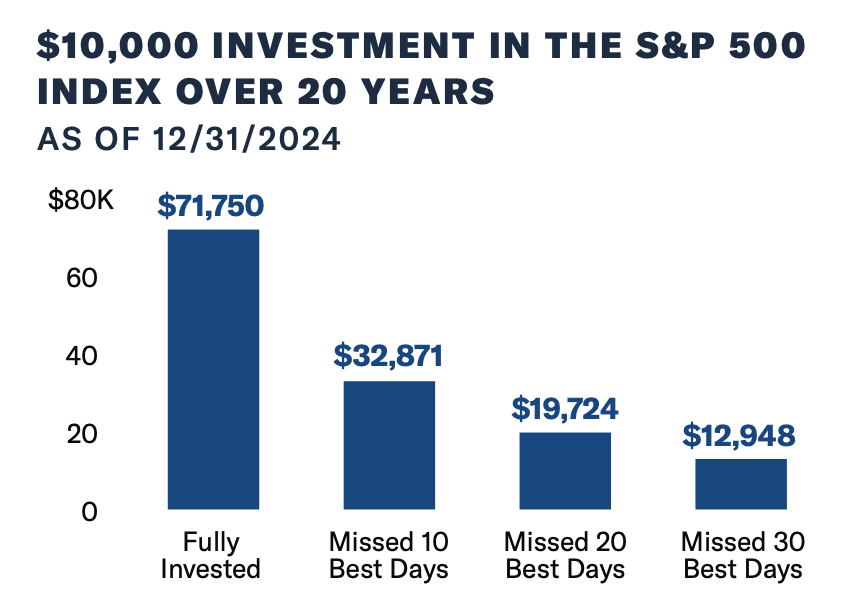

1. Stay Invested. Market downturns can make any investor feel uneasy. However, history shows that stocks can quickly recover—but timing is hard to pinpoint. The key to building wealth over time is to stay invested and not try to time when to get in and out of the market. Here’s why: As shown in the chart, over the past 20 years, $10,000 invested in the S&P 500 Index has grown to over $70,000. However, if an investor had sold out of stocks and missed the best 10, 20 or 30 days during the period, their investment balance was significantly lower.

Had an investor sold out of stocks during the global reaction to the tariff announcements, they would have missed the S&P 500’s 9.5% rally on April 9, 2025, the highest one-day gain since 2008.

2. Diversify Your Portfolio. A diversified portfolio involves investing in different types of assets that are more likely to have different risk and return characteristics. Therefore, an investor’s overall return doesn’t rely too much on any single investment. Different types of assets include domestic and international stocks, bonds, and short-term investments.

The performance of any one segment of the market is impossible to predict with certainty, and asset classes perform differently in various economic conditions. Also, stocks that performed well in the past may not be top performers in the future. For example, international stocks have performed relatively well as compared to U.S. companies in the first quarter of 2025 after years of underperforming the U.S. market. Utilizing a variety of stocks, bonds and short-term investments may help an investor avoid significant declines to their overall portfolio if any one investment segment lags in the short term.

3. Invest Consistently. Take the emotion out of investing by contributing on a regular basis. This concept, called dollar cost averaging, is when an investor buys shares of an investment at a regular interval. Investing a fixed amount of money on a monthly or quarterly basis regardless of the asset’s price, takes away the emotional impact of investing, may lower the average cost of the investments and may reduce the impact of market volatility on their overall portfolio.

Keep In Mind

Market downturns are a normal part of investing in the stock market. While these downturns can be unsettling for investors in the short run, they are part of the market cycle. Consider reaching out to a Financial Advisor who can work with you to develop a long-term investment strategy that will help you stay the course when markets experience a short-term decline.

JPMorgan Guide to the Markets, March 2025.

https://www.marketwatch.com/story/after-two-big-days-of-selloffs-heres-what-history-suggests-will-happen-next-efd723dd?mod=home_lead.

Past performance is no guarantee of future results. The index returns discussed above are for illustrative purposes only and do not represent the performance of any investment or group of investments. Indexes are unmanaged and not subject to fees or expenses. The index returns above reflect the reinvestment of distributions. It is not possible to invest directly in an index. Diversification cannot assure a profit or protect against loss in a down market.

The views expressed in this article are subject to change at any time based on market and other conditions and should not be construed as a recommendation. This article contains forward-looking statements, which speak only as of the date they were made and involve risks and uncertainties that could cause actual results to differ materially from those expressed herein. Readers are cautioned not to rely on our forward- looking statements.

The information has been provided as a general market commentary only and does not constitute legal, tax, accounting, other professional counsel or investment advice, is not predictive of future performance, and should not be construed as an offer to sell or a solicitation to buy any security or make an offer where otherwise unlawful. The information has been provided without taking into account the investment objective, financial situation or needs of any particular person. Mutual of America is not responsible for any subsequent investment advice given based on the information supplied.

Mutual of America Capital Management LLC is an indirect, wholly owned subsidiary of Mutual of America Life Insurance Company. Securities offered by Mutual of America Securities LLC, Member FINRA/SIPC.

Insurance products are issued by Mutual of America Life Insurance Company.