Insights Economic & Market Perspective: April 2025

By: Jamie Zendel, FRM

Date: 4/22/2025

As the first quarter of 2025 ended, the U.S. economy and financial markets were showing signs of strain following a robust 2024. Recent data suggest the outlook for the remainder of this year has grown more uncertain, as inflation trends reaccelerate, consumer sentiment softens and economic growth moderates. While this may lead the U.S. Federal Reserve to reconsider the pace and number of rate cuts, potential tax cuts and deregulation could help counterbalance the impact of tariffs and keep the economy on track.

Market Performance A Mixed Bag

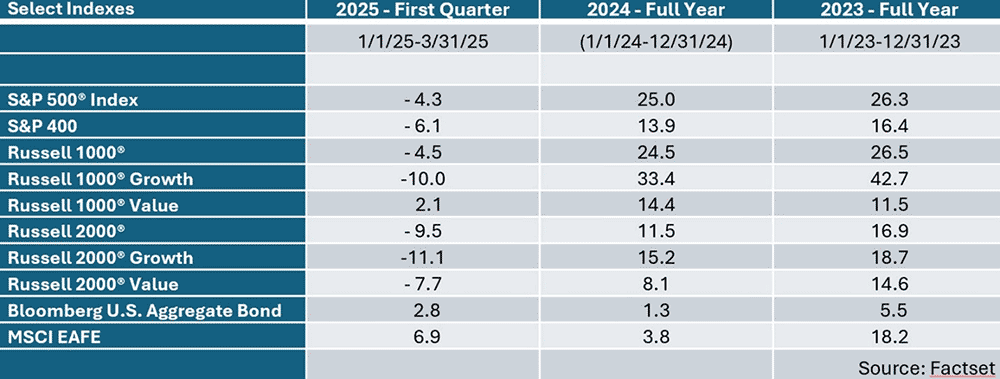

Taking a look at equities during the first quarter, the S&P 500® Index declined 4.6%, its worst quarterly performance since 2022. Equity markets stumbled in late January as investors grew concerned about the sustainability of robust AI-related capital spending. After a brief recovery, markets declined again in late February, this time driven by a weaker than expected consumer sentiment survey.

Mid-cap and small-cap stocks both underperformed their large-cap counterparts for the quarter, with the S&P 400® Index and Russell 2000® Index down 6.0% and 9.3%, respectively. As for the valuation gap regarding forward price/earnings, small cap (16.5x) stocks are trading at a discount compared to their large cap (21x) counterparts.

In a reversal from the last two years, value stocks outperformed growth stocks in the first quarter of 2025. As technology stocks, including the Magnificent 7, declined due to economic uncertainties and potential trade tensions, investors gravitated toward more defensive and less cyclical stocks. In addition, international markets, as measured by the MSCI EAFE, finished up 6.9%, ahead of all U.S. indices.

The Bloomberg U.S. Aggregate Bond index gained 2.8% in the first quarter, driven by investor shifts toward safer assets amid equity volatility and concerns over economic growth.

Weaker GDP Growth Anticipated

After expanding by 2.8% in 2024, Real GDP growth is showing signs of moderation. Economists’ expectations for full year GDP estimates are currently being revised downward as policy uncertainty has spiked in recent weeks. Prior to the revisions, estimates averaged 1.9% growth in 2025. The range of forecasts for the first quarter is unusually wide, ranging from approximately -2% to +2% as the market awaits clarity.

Business Investment Softens and Consumers Show Concern

The Institute for Supply Management’s (ISM) Purchasing Managers Index (PMI) is a widely monitored indicator of industrial activity. A reading below 50 signifies that companies are reporting contraction instead of expansion. During March, the PMI reading dropped to 49 from 50.3 a month earlier, signaling weakness in the manufacturing sector. Overall demand remains soft, and businesses continue to manage output and inventories cautiously.

Looking at consumers, the February Survey of Consumer Expectations by the Federal Reserve Bank of New York revealed growing anxiety among U.S. households. More people are worried about their household financial situation, with a notable increase in those expecting their finances to worsen over the next year. Concerns about missing debt payments also rose, reaching levels not seen since early in the pandemic. Overall, the results highlight a shift toward greater financial stress and uncertainty, despite broader economic resilience.

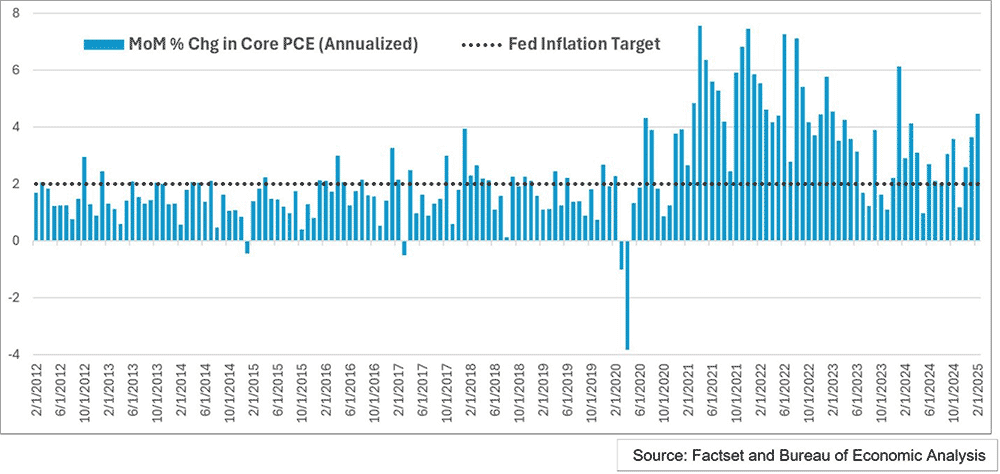

Higher Core PCE Inflation

While inflation had moderated from its peak in 2021, and then again following the Federal Reserve’s tightening of monetary policy in March 2022, inflation has proven to be persistent. The Fed’s preferred inflation gauge—the core Personal Consumption Expenditures (PCE)—calculated on a month-over-month annualized basis, rose to 4.5% in February, following 3.6% in January and 2.6% in December. The upward trend is concerning, especially given the continued high prices for housing (shelter) and services.

As inflation remains sticky, it has narrowed the case for further interest rate cuts. In late 2024, the Federal Reserve initiated its easing cycle with 100 basis points of cuts, with a half-a-percentage point reduction in September, followed by two quarter point cuts in November and December.

Federal Reserve, Interest Rates and Labor Market

Throughout the first quarter, the yield curve experienced periods of inversion, where short term yields exceeded long term yields. This type of activity is typically viewed as a recession indicator. By the end of the quarter the spread between the 10-year Treasury yield and 2-year Treasury yield was about 0.33%, a modestly positive slope but still near inversion territory.

At its March 18-19 meeting, the FOMC left the Federal Funds Rate unchanged at a range of 4.25% to 4.50%, with the median projection of two rate cuts by year end 2025, as per the Fed’s Summary of Economic Projections.

In Federal Reserve Chair Jerome Powell’s speech on April 4 at the Society for Advancing Business Editing and Writing Annual Conference, he noted “the tariff increases are significantly larger than expected” and are likely to result in both higher inflation and slower economic growth. Following his remarks, traders are now forecasting the Fed will cut interest rates at least four times this year amid fears the tariffs could tip the U.S. into a recession.

Powell suggested the Fed is not in a hurry to make immediate changes particularly because the labor market remains supportive. The March 2025 unemployment rate held steady at 4.2%, signaling a resilient labor market, though signs of cooling have emerged. The latest Job Openings and Labor Turnover Survey (JOLTS) program data showed a continued decline in job openings, suggesting the strength of the labor market is easing. Quit rates also remained steady, indicating that workers are feeling less confident about finding new opportunities.

Earnings Estimates

Corporate outlooks are becoming more cautious amid growing macro uncertainty. Until early April, companies avoided commenting on tariff risk due to lack of clarity around administration policy. As the first quarter reporting season begins, tariffs will likely push companies to address the cost risk on earnings calls, shifting the discussion to supply chain strategy and margin resilience.

Analysts have begun revising full-year 2025 S&P 500 earnings lower, and are now expecting $269.53 in earnings per share with growth slowing to 11% from 14%, reflecting softer demand and persistent inflation. Going forward, much depends on how long tariffs remain in place and whether companies view them as temporary disruptions or long-term headwinds.

Outlook

As stock markets experience heightened volatility, maintaining composure and focusing on a long-term investment strategy are essential to avoid impulsive decisions.

The U.S. economy may face increasing uncertainty in 2025, with challenges such as rising inflation pressures and waning consumer sentiment reflecting increased pessimism. However, potential policy measures, such as tax cuts and deregulation, may help mitigate the impact of inflation and tariffs.

Both equity and fixed-income markets are likely to remain volatile, as investors process conflicting signals from inflation trends, monetary policy and corporate earnings. Despite this, there are still selective opportunities for investors who prioritize diversification and effective risk management to navigate the complexities of unpredictable markets.

Jamie Zendel is EVP, Head of Quantitative Strategies, at Mutual of America Capital Management LLC.

Past performance is no guarantee of future results. The index returns discussed above are for illustrative purposes only and do not represent the performance of any investment or group of investments. Indexes are unmanaged and not subject to fees or expenses. The index returns above reflect the reinvestment of distributions. It is not possible to invest directly in an index.

The views expressed in this article are subject to change at any time based on market and other conditions and should not be construed as a recommendation. This article contains forward-looking statements, which speak only as of the date they were made and involve risks and uncertainties that could cause actual results to differ materially from those expressed herein. Readers are cautioned not to rely on our forward-looking statements.

The information has been provided as a general market commentary only and does not constitute legal, tax, accounting, other professional counsel or investment advice, is not predictive of future performance, and should not be construed as an offer to sell or a solicitation to buy any security or make an offer where otherwise unlawful. The information has been provided without taking into account the investment objective, financial situation or needs of any particular person. Mutual of America is not responsible for any subsequent investment advice given based on the information supplied.

Mutual of America Capital Management LLC is an indirect, wholly owned subsidiary of Mutual of America Life Insurance Company. Insurance products are issued by Mutual of America Life Insurance Company, 320 Park Avenue, New York, NY 10022-6839. Mutual of America Securities LLC, Member FINRA/SIPC distributes securities products. Mutual of America Retirement Services LLC provides administrative and recordkeeping services. Mutual of America Financial Group is the trade name for the companies of Mutual of America Life Insurance Company.